Please note: the legislation explained below is not yet enacted in law and is still pending.

Summary

The so-called 30-20-10 % adjustment to the ruling will be revoked as per 1 January 2025. Instead, the 30% ruling will be decreased to a 27% ruling, and the salary norms will become higher as of 1 January 2027.

There is specific transitional legislation to be considered in the future.

- From 30% to 27% ruling (maximum tax-free allowance)

This change will take effect on January 1, 2027:

- Up to 30% tax free allowance will remain in effect for 2025 and 2026.

- As of 2027: there will be a distinction between employees who utilized the 30% ruling before January 1, 2024, and those as of 1 January 2024.

- Increased Salary Norm

New salary norms will also come into effect on January 1, 2027.

This adjustment will apply to employees starting to use the 30% ruling from January 1, 2025.

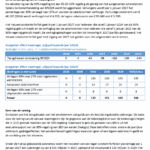

Overview of Employee Groups from January 1, 2027

By this date, we will have three distinct groups of employees in view of the transitional legislation

| Start date using the 30% ruling | 2025 and 2026 | From 2027 |

| By December 31, 2023 | 30% and current indexed salary norm | 30% and current indexed salary norm |

| In 2024 | 30% and current indexed salary norm | 27% and current indexed salary norm |

| From January 1, 2025 | 30% and current indexed salary norm | 27% and new indexed salary norm |

Salary Norms from January 1, 2027, onwards

- General Norm: Increases from €46,107 to €50,436 (2024).

- Under 30 with a master’s degree: Increases from €35,048 to €38,338 (2024)

Please note that these amounts will be indexed annually, meaning they are likely to increase further due to adjustments.

As a reminder, the fiscal wage after applying the ruling (27% or 30% tax free allowance) must exceed these salary norms.

Cap on the application of tax-free allowance on this ruling

A further reminder on this topic. There is salary cap to consider when applying the tax-free allowance in the payroll:

Maximum salary base for the 30% ruling: EUR 233,000 (2024)/max tax-free allowance: EUR 69,900 en in 2025: EUR 246,000 (maximum tax free allowance: EUR 73,800)

Transitional period:

However, a transitional arrangement applies, on the basis of which this limitation to the 30% facility only takes effect as from 1 January 2026, for employees on whose wages the 30% facility was already lawfully applied in the final salary period of 2022.

Repeal partial non resident taxpayer status as per 1 January 2025

Currently, employees in The Netherlands who have been granted the 30% facility, can opt for the so-called partial non-resident taxpayer status. This status enables the employees (and their fiscal partners) to be treated as non-resident taxpayers, for the purposes of Box 2 (income from a substantial interest) and Box 3 (income from savings and investments), even if they reside in The Netherlands. Based on legislation enacted in 2024, as of 1 January 2025, this status will be repealed. This change is not revoked by new legislation. Employees who have a valid 30% facility grant and have applied the 30% facility during the final wage period of 2023 (i.e. normally December 2023), may retain the partial non-resident taxpayer status until 1 January 2027.

Conclusion

Employers need to make sure that the employees are aware of the changes as this may impact their net salary.

Employers using a net salary agreement should be aware about the impact on the total salary costs.

If you have any questions or need further clarification, feel free to reach out!

Source: Ramingstoelichting 30_ regeling 2e NvW BP25.pdf and